modern portfolio theory - Given two risky stocks calculate the rate of return, standard deviation, beta, and risk-free rate - Quantitative Finance Stack Exchange

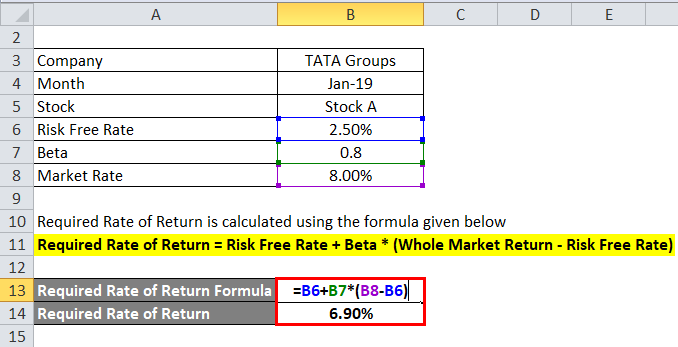

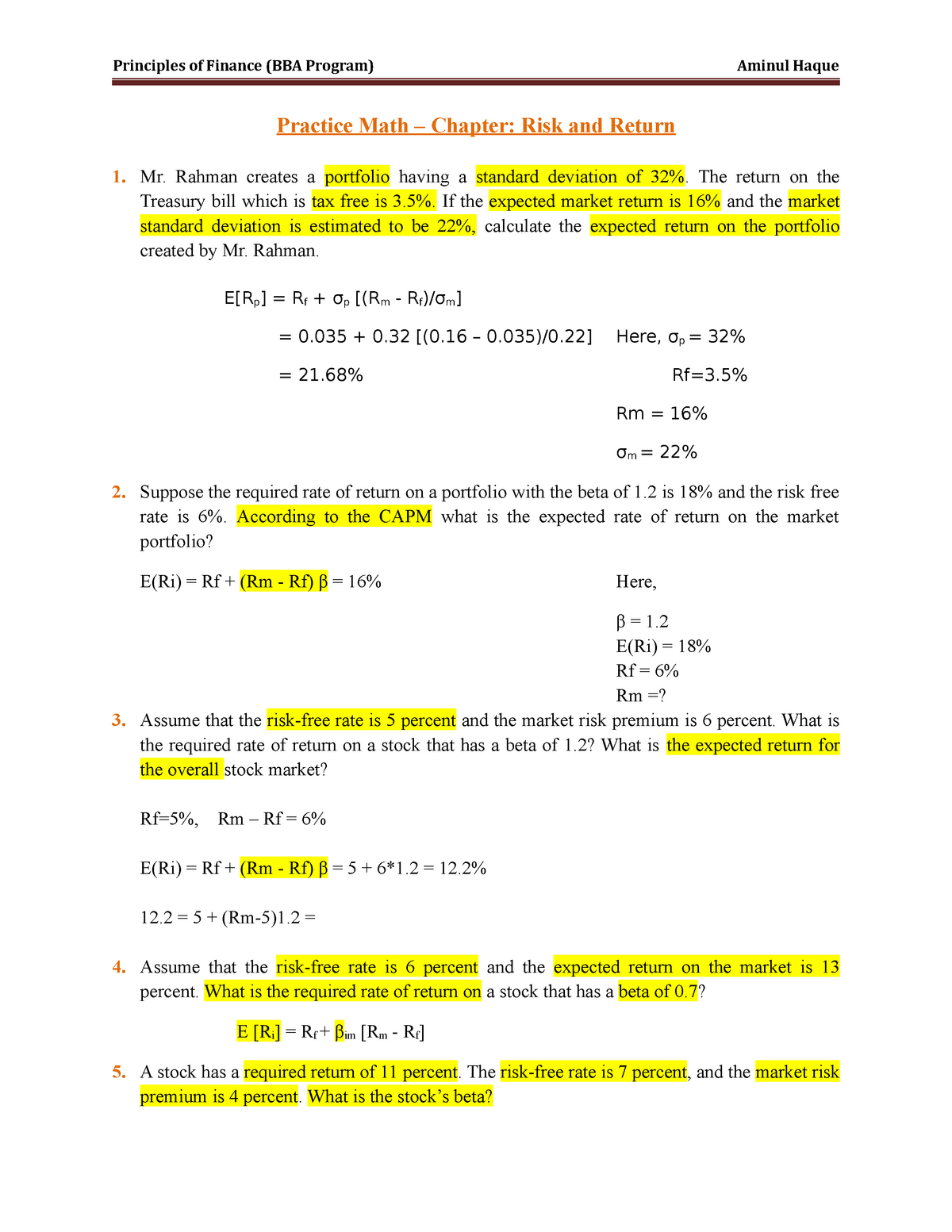

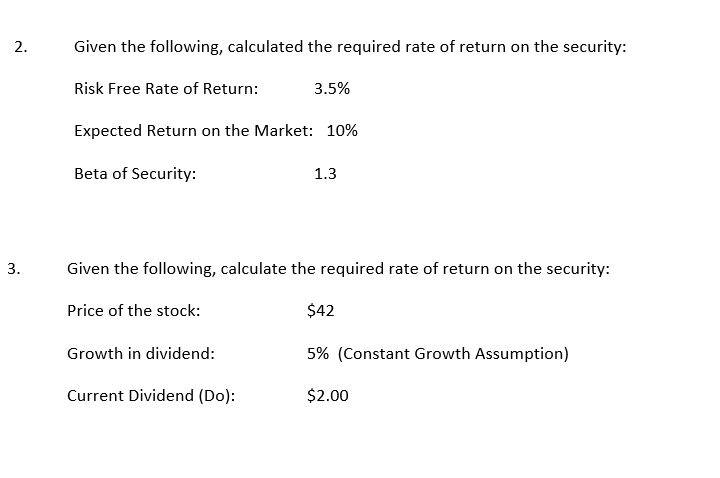

Practice Math - This document is helpful for who take financial management system course as - Studocu

How to compute beta, expected return, and volatility for a portfolio of the stock market and T bills - YouTube

.webp)

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)